Reasons for Exhibiting

.jpg)

Why China Market

Trends in China's beer industry

As the largest producer and seller of beer, China's beer industry has entered a period of "stable volume and rising prices", with beer prices steadily increasing.

Despite consecutive years of declining beer production, a rebound growth was achieved in 2021 and maintained a good momentum of growth in 2022. According to data from the National Bureau of Statistics, from January to December 2022, beer enterprises above designated size included in the scope of the National Bureau of Statistics completed beer production of 35.687 million kiloliters, a year-on-year increase of 1.1%. From the perspective of beer consumption in 170 major markets worldwide, China has become the largest beer consumer country, ranking first in global beer consumption for 19 consecutive years, accounting for 64.4% of the Asia Pacific market share and 21.5% of the global market share.

Overview of the Development of China's Craft Beer Industry

In 2022, China's mid- to high-end beer production and sales volume were approximately 15-18 million kilolitres, accounting for 35-40 percent of the industry's total sales volume, of which high-end and ultra-high-end products accounting for about 15-20 percent. The craft beer market has a share of nearly 40% in the upper end of the market. The sales scale of craft beer in China in 2022 is approximately 600000 to 700000 kiloliters.

Since 2021 to July of this year, craft beer-related brand products have completed a cumulative total of 23 financing events. Since 2022, the total investment amount of 14 craft beer expansion projects nationwide has exceeded 7.5 billion Yuan. As of 28 May 2023, there were 8,792 craft beer-related companies in Chinese market.

Development Trends of Chinese Craft Beer Industry

1) Continuous upgrading of craft brewing technology

As of the end of 2022, China's craft beer patent applications amounted to 880, with an increasing number of applications year by year;

2) Multi-industry players enter into craft beer track

In addition to beer companies, catering enterprises, retailers, and e-commerce enterprises have layout of the R & D and production of craft beer;

3) Craft beer flavors are more distinctive

The localization process of craft beer is still in its early stages, and it will develop towards fruit brewing, localization, and refinement in the future;

4) Diversification of consumption channels

The bistro model is rapidly emerging, and specialty catering brands are popping up.

CBCE - Asia-Pacific’s One-stop Craft Beer Platform

Member of Beviale Family

Craft Beer China Conference & Exhibition became a member of Beviale Family through made a marketing agreement with BrauBeviale in Germany which the world's largest show in beer and beverage. CBCE is setting down as an international exhibition that enables to meet the key players in the beer industry.

Field of visitors

Large Breweries | Middle / Small Size Breweries (Including Craft Breweries) | Catering / Tap Houses / Hotels / Supermarkets | Distributors / Agents | Raw Material Suppliers | Equipment Manufacturers | Brewery Technical Services | Other Technical Services | Academy, University | Association | Others

Exhibit profile

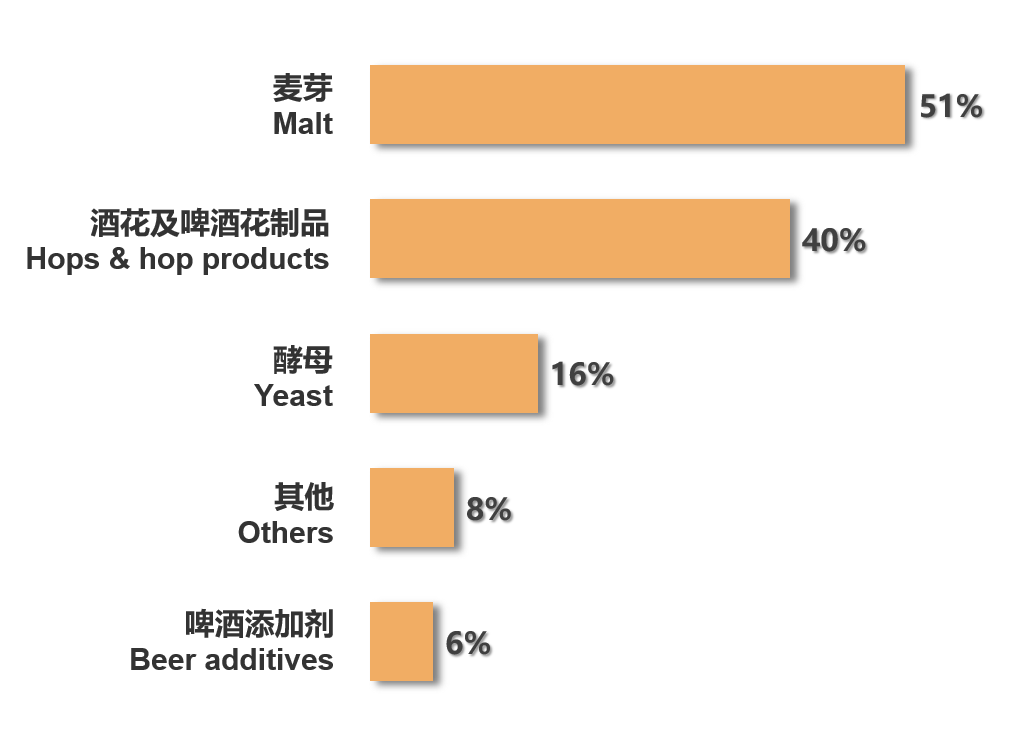

Raw Material | Production Technology and Equipment | Beer Brewery | Technical Services | Marketing Services & Other Services

6 exciting accompanying programs

Beer Tasting Event | Products Exhibition & Business Match Making | Craft Beer Forum | Book Signing | Chinese Map of Craft Beer Breweries | Craft Beer Banquet

Scan the QR code to follow us

Scan the QR code to follow us